Summary of Insights

Amid increasing global health challenges and financial slowdowns, the Health Tech sector is witnessing significant changes and the adoption of new technologies and models of innovation. Workforce shortage, burnout, the need for cost reduction, and healthcare equality are among the key challenges.

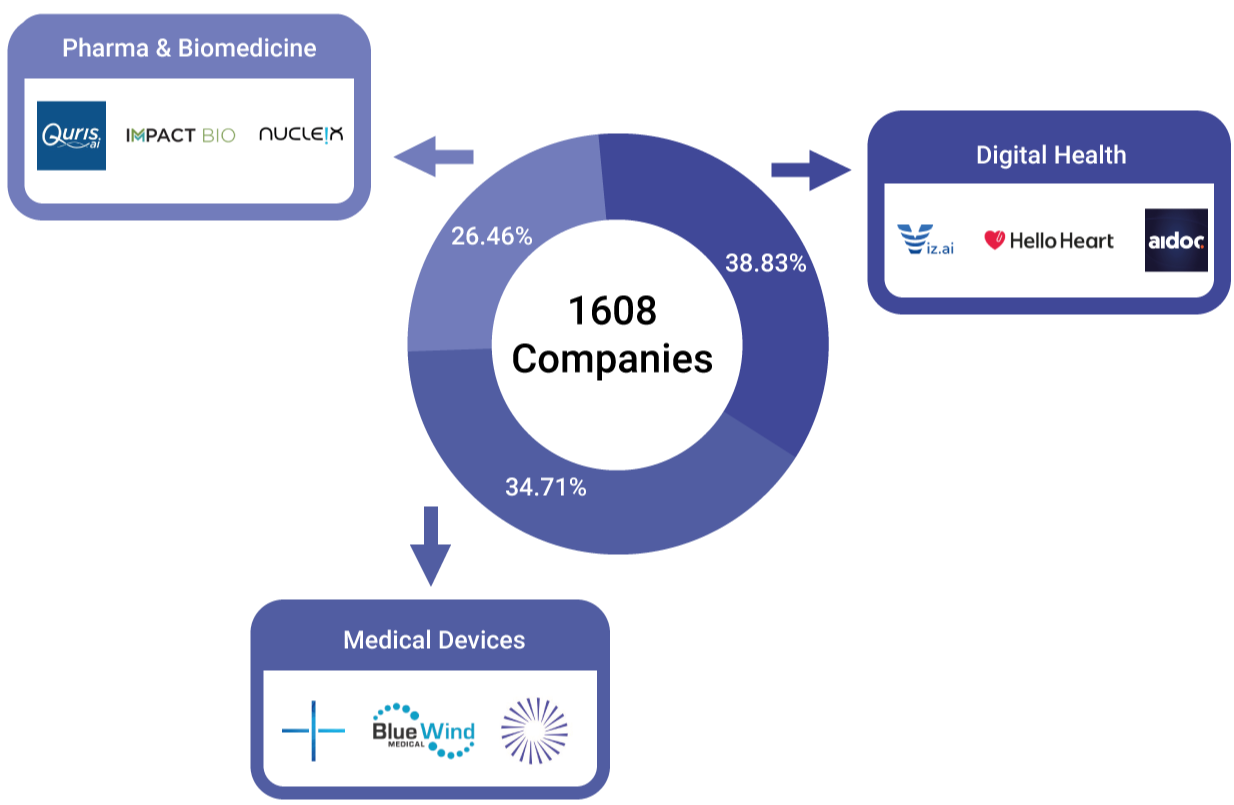

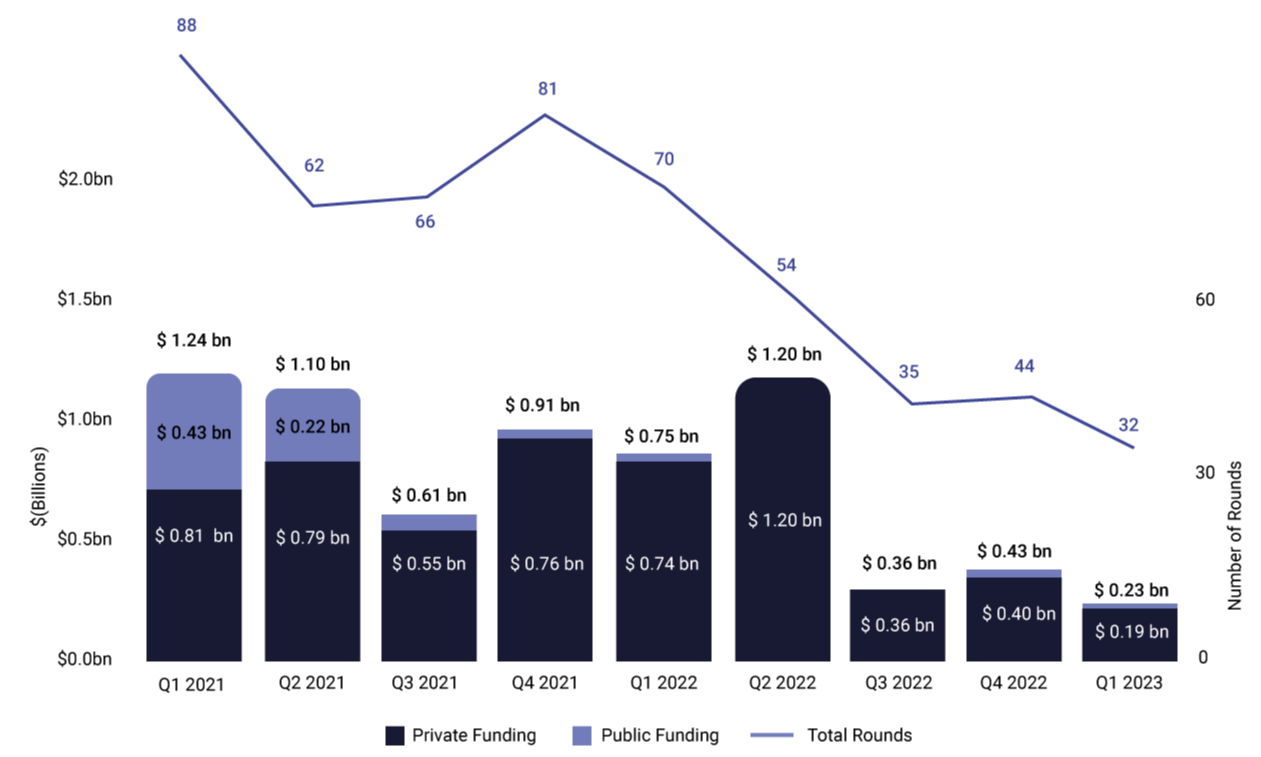

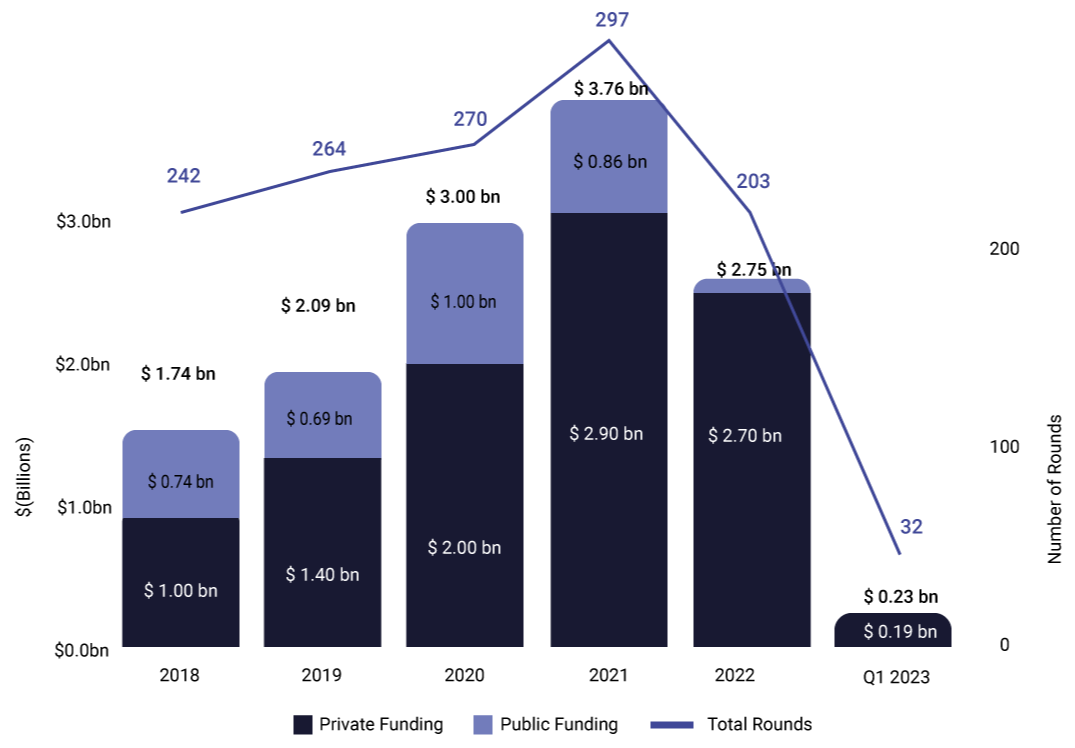

In 2022, the Health Tech sector raised $2.75B in funding, a decrease of 27% from the previous year. Compared to other sectors, this decline was relatively modest. While the sector comprises over 1,600 companies (the highest amongst all the sectors), it ranked fourth in terms of overall investments.

However, the Health Tech sector experienced a slowdown in Q1 2023, with only $226M in equity invested across 32 rounds, a nearly 50% decrease from Q4 2022, and a 70% fall compared to the first quarter of the same year.

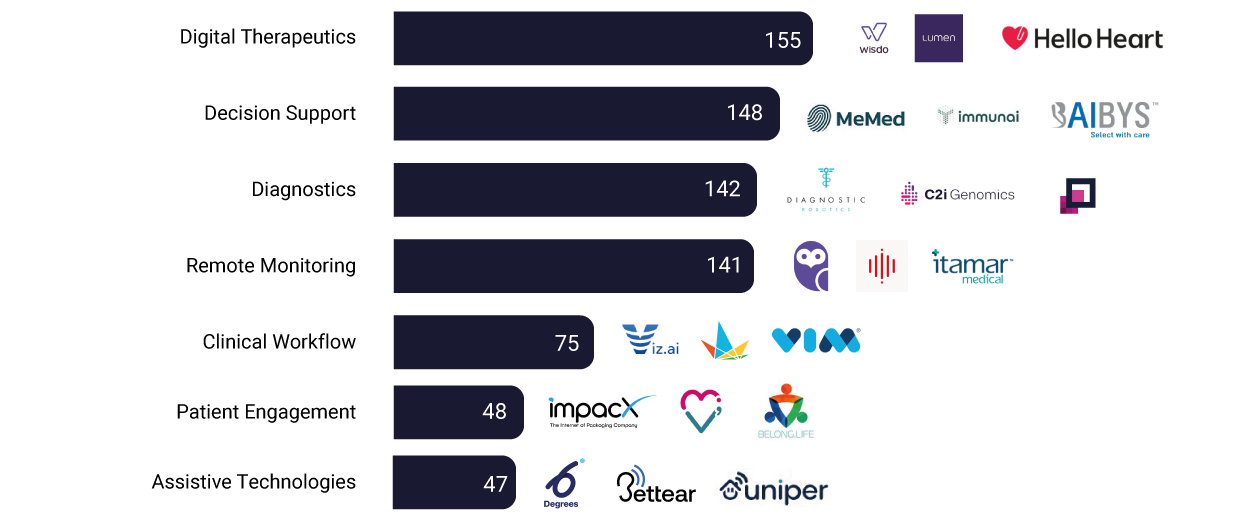

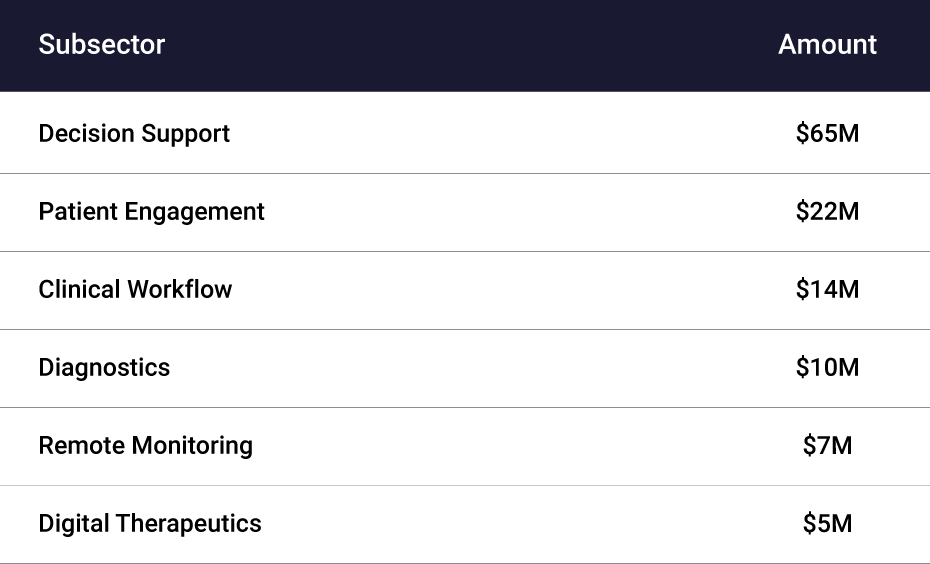

Two clusters of companies stood out in terms of private capital raised, namely digital health companies dealing with decision support, and medical device companies dealing with treatment therapeutics. Additionally, artificial intelligence is a growing and leading core technology in the Health Tech sector, with over 58% of companies and 61% of deals. We anticipate a continued increase in the use of artificial intelligence, big data, and machine learning technologies across all three subsectors - digital health, medical devices, and pharma.

At Start-Up Nation Central, we are mapping, monitoring and connecting Israeli healthcare ecosystem players to global challenges and business opportunities. We provide access to transparent and quality data on the sector, and create business opportunities for multinational corporations, investors and government leaders to engage with the entrepreneurship community. We are curating focused programs to help Israeli startups enter the US market, as well as serving as a gateway for clinicians entering and strengthening the industry.

Dr. Iris Adler, Health Tech sector lead at Start-Up Nation Central

Contact me