2) Align with your funding stage

Your pitch deck should reflect the maturity of your startup. Early-stage companies should focus on vision, team, and market potential, emphasizing the problem and your innovative solution.

As you progress, the emphasis shifts towards traction, growth metrics, and financials. Understanding what VCs expect at each stage and tailoring your deck accordingly can make your pitch more compelling and relevant.

3) Adjust for different types of VC investors

VCs come in various flavors, from those specializing in early-stage startups to those focusing on specific sectors like tech, healthcare, or sustainability.

Researching and understanding the types of investments a VC firm makes can help you adjust your pitch to highlight the most relevant aspects of your business.

Whether it's your technology's groundbreaking nature or your business model's scalability, make sure your deck speaks their language.

4) Show, don’t tell

In a pitch deck, effective visuals can convey complex information quickly and memorably. Use charts, graphs, and images to illustrate your points, from market growth trends to user engagement metrics.

Interactive elements can bring your data to life, making your case more compelling without overwhelming your audience with text.

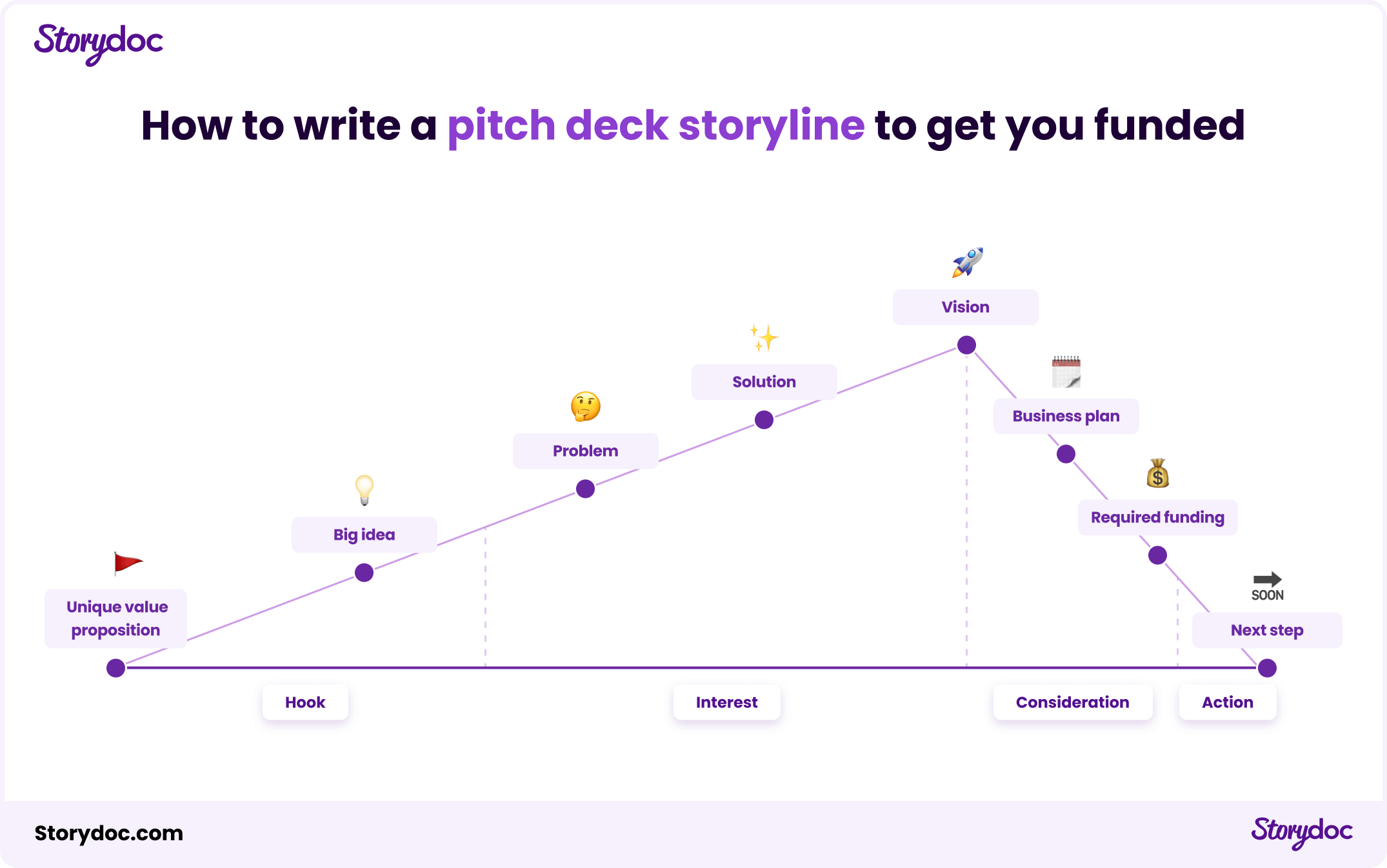

5) Leverage the power of storytelling

Your pitch deck should tell a story, one that takes VCs on a journey from identifying a pressing problem to presenting your solution as the inevitable answer. Use storytelling techniques to create a narrative arc that builds interest and culminates in a clear call to action.

Engage emotions and logic, weaving in customer testimonials or case studies to make your startup's impact tangible.

James Currier, Founding partner at NFX, says: