How to write an investment proposal that gets you buy-in

Writing a business proposal for investors is a critical step in securing funding for your business. It's your chance to make a compelling case to potential investors about why your business is a worthy investment.

A well-crafted proposal can be the difference between securing the funds you need and missing out on a crucial opportunity. Let's dive into the key steps to create an effective investment proposal.

1) Know who you’re pitching to

Before penning down your proposal, start by researching your potential investors. Use platforms like Crunchbase or AngelList to understand their investment history, sectors of interest, and investment patterns.

Are they risk-takers or conservative? Do they prefer tech startups or are they inclined towards sustainable businesses? This knowledge will help you tailor your proposal to resonate with their specific interests and investment philosophy.

2) Balance business and emotional needs

Ever noticed how you're more drawn to products or ideas that tug at your heartstrings? That's because our decisions are often influenced by emotions, not just logic.

To create this emotional connection, dive deep into what motivates your investors. Use the "jobs to be done" methodology to frame your product as the perfect solution to their problem.

Think about the "job" your investor needs to accomplish and how your solution is the perfect "hire."

Paint a vivid picture of how your business addresses a genuine problem or enhances lives. This emotional appeal can transform your proposal from just interesting to truly compelling.

3) Create a strong executive summary

Think of the executive summary as your elevator pitch in written form.

In just a few sentences, you need to capture the essence of your business idea, the opportunity in the market, what sets you apart (your unique value proposition), and the investment you're seeking.

This section should be so engaging that investors can't help but want to read on.

4) Address the challenges your customers face

To really hit home with your proposal, you need to show that you get what your customers are going through. Are they frustrated with complicated processes, high costs, or just finding it hard to get things done?

By showing you understand these everyday headaches, you can better position your business as the ideal solution. It's about saying, "We know what you're dealing with, and here's how we can make it better."

This approach not only builds trust but also clearly demonstrates how your business can make their lives easier.

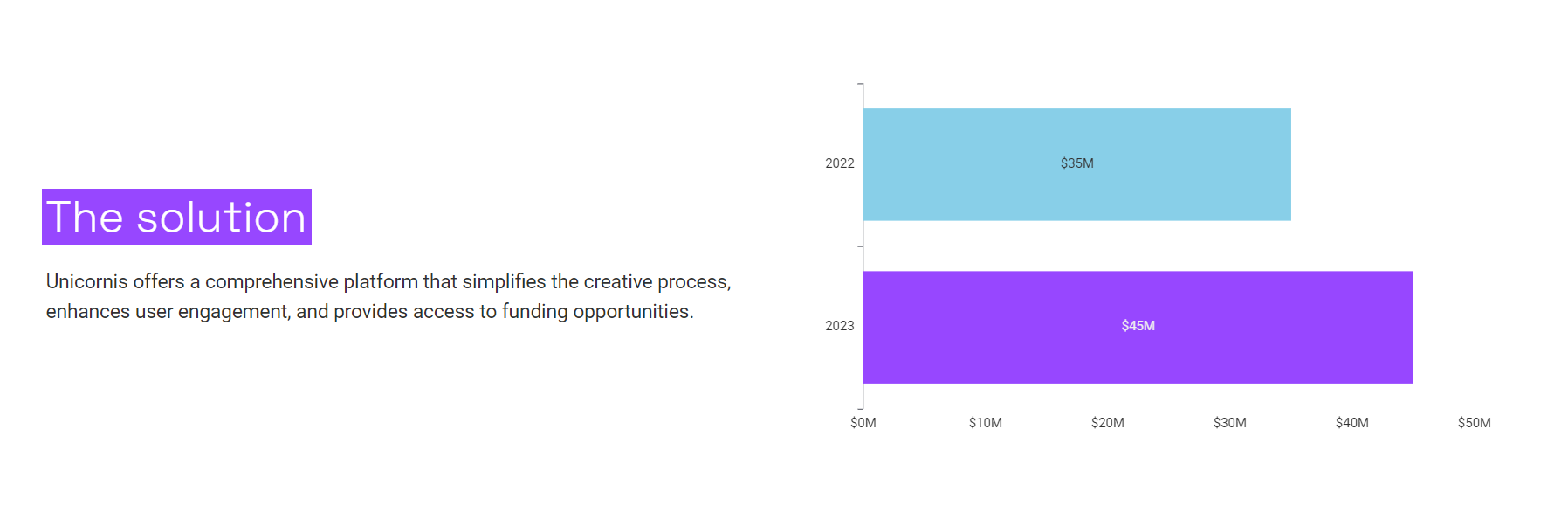

Here's a great example of a problem slide: