How to Write a Pitch Deck as Advised by VCs (2025)

Learn how to write a pitch presentation for investors. How to structure a pitch deck and prepare your narrative to stand out, charm investors, & get funding.

Learn how to write a pitch presentation for investors. How to structure a pitch deck and prepare your narrative to stand out, charm investors, & get funding.

Short answer

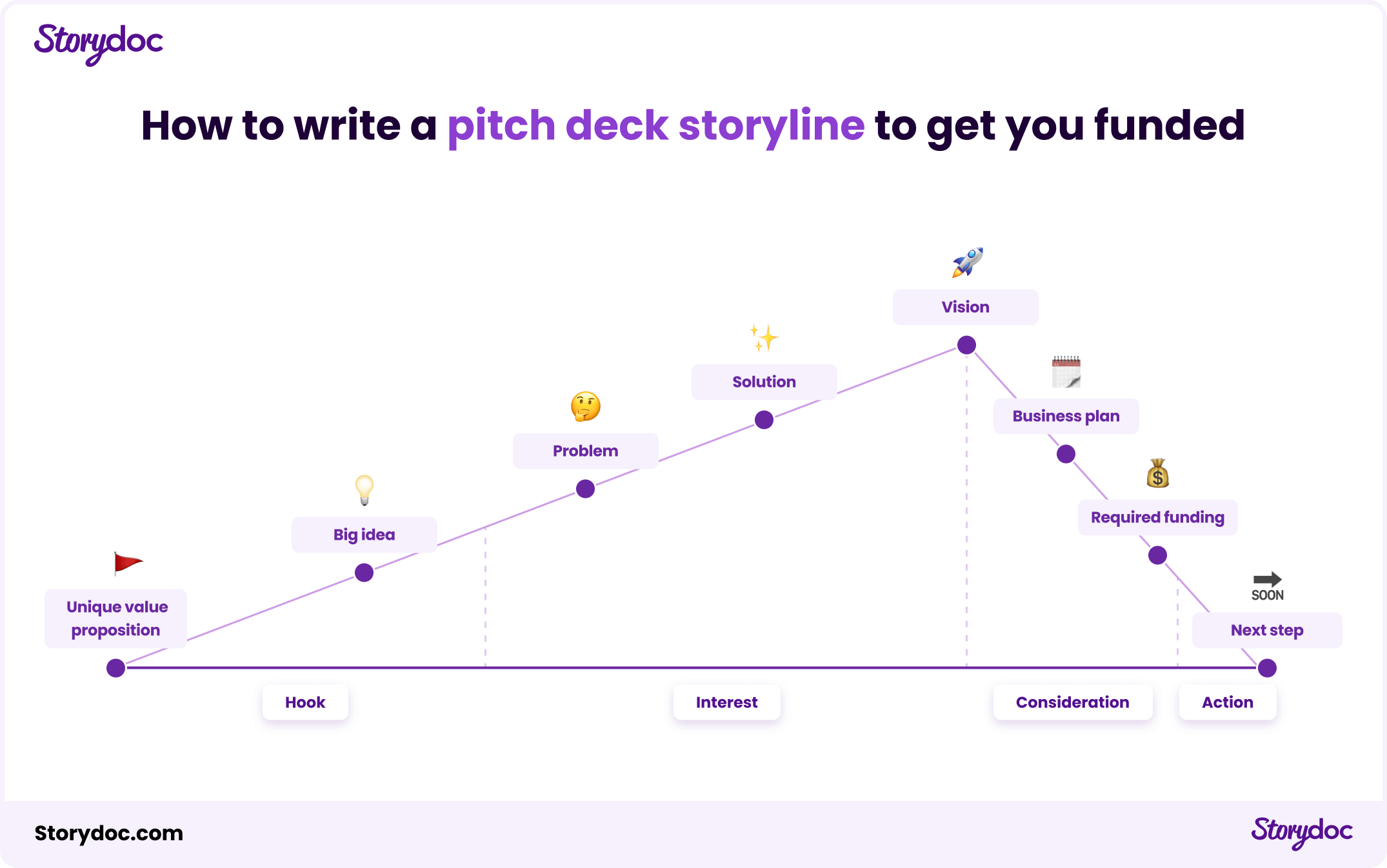

1) Unique Value Proposition

2) Big idea (elevator pitch)

3) Problem

4) Solution

5) Market & Vision

6) Business plan (hard numbers)

7) Traction

8) Team

9) The ask

10) Next step

NOTE: Before you write your pitch presentation to investors remember, it's not just about securing funds, but about finding the right partners to help your startup thrive.

You are looking for people you trust, who have experience working with similar startups, and with whom you’d enjoy spending time. If you choose the right investors for you, it’s likely they will think the same.

Stop losing opportunities to ineffective presentations.

Your new amazing deck is one click away!