How to Make a Pitch Deck That Gets Funded (+Templates)

Create a pitch deck that gets noticed and gets you funded. Learn the best structure and what to include in a pitch deck that investors will love.

Create a pitch deck that gets noticed and gets you funded. Learn the best structure and what to include in a pitch deck that investors will love.

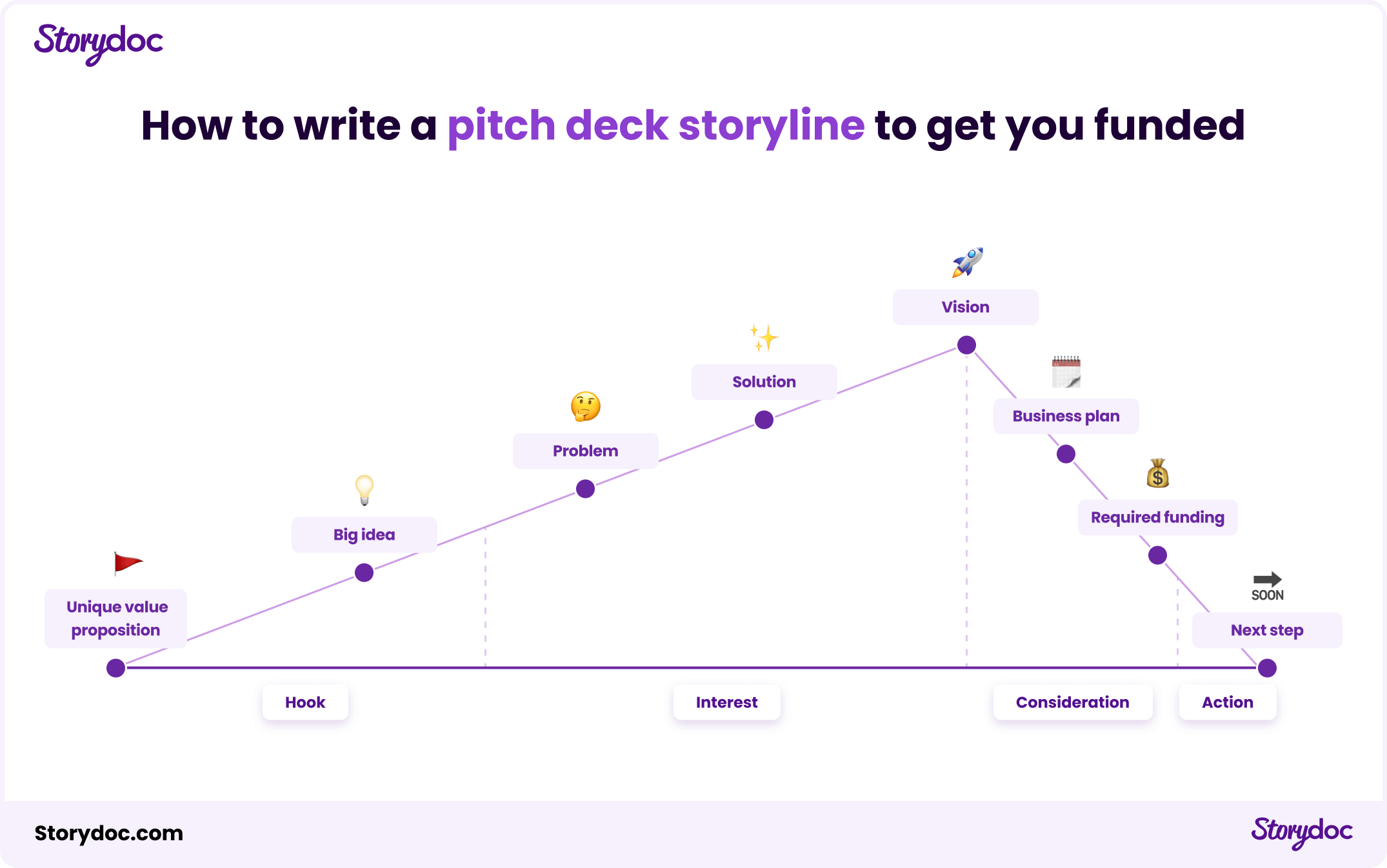

11 slides to include in your pitch deck:

Read detailed breakdown further down ⤵

How to create a pitch deck title slide?

Add subtle (non-distracting) movement

Movement helps to anchor the eye, it grabs attention and points it to where you want it to go.

Direct attention to the title text by adding movement that goes towards the title text and not away from it.

Make sure the movement does not distract from the text, it can’t be too fast or too big so that it can’t be ignored.

Make sure the movement does not make your title text hard to read like placing the the text on top of a video.

Show your product in action

Showing your product makes you unique and specific, which is the opposite of generic (the enemy of all pitch decks).

Include a video that shows how your product works, and how people happily interact with it.

Or add a high-res image of your product showing a central feature.

Make your title text a short version of your UVP

The title text is your “Open sesame!”. If you say what investors are looking for, the door will open.

And what are they looking for? A clear statement of what you’re about. It should be a short version of your UVP in 16 words or less.

You can add a tagline to get in there some extra dazzle. But make it short.

How to create a pitch deck introduction slide?

Offer your unique value proposition

Describe what you offer that no one else does. Preferably something that no one else can (or investors will ask why bigger competitors won’t just rip you off).

Your customer value proposition should describe who your offer is for and what needs it satisfies.

Make it short and make it simple.

Provide a short overview of your product or service

Your overview should be easily understandable even to investors who aren’t familiar with your industry or technology.

However, since an overview can involve a lot of text, which often becomes cumbersome, I recommend using a text to video AI tool to transform these descriptions into more engaging video content.

A video can’t overflow the space it is given, and it’s visual and auditory, and hence more engaging.

How to write a pitch deck solution slide?

Simplify

Questions your market analysis slide must answer:

How to prepare a pitch deck business model slide?

Outline your main revenue model

Where will the money come from? Will most of it come from active revenue streams (a one-time fee or a subscription to use your solution), passive ones (advertisements and affiliate revenue), or will it be a combination of both?

Elaborate on your positioning in the market

Is it a premium solution for the high-end market? Or, does your competitive advantage lie in a more affordable offer?

If your company has tiered pricing, make sure to present the different pricing plans and explain the main differences between them.

If you have already validated your revenue streams prior to pitching to investors, you’re already at an advantage.

Present the results of your market tests that show customers are willing to pay your price in order to minimize the fear of risk in potential investors.

Questions the marketing slide should answer:

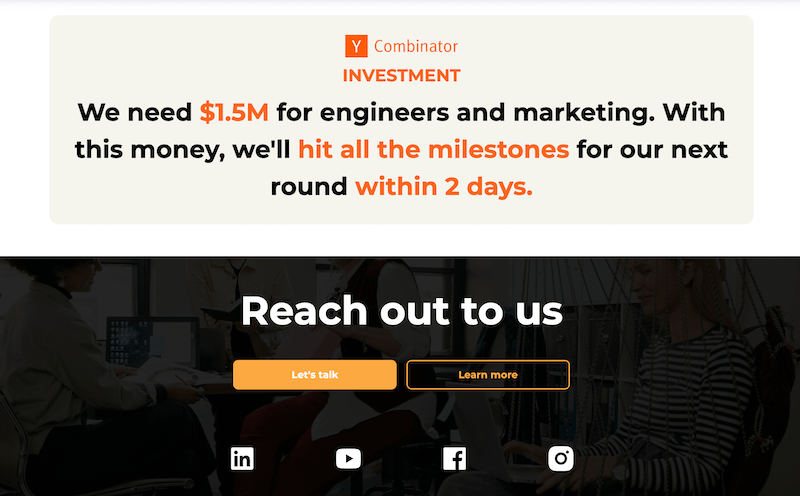

Tell investors how their money is going to create value:

Note: to get a great first pitch deck version you can run it by this immensely useful AI-powered pitch deck review tool by Haje Jan Kamps. It’ll help you verify that you're headed in the right direction.

I tested it out. It's really thorough. The report I got from the tool is added below.

Stop losing opportunities to ineffective presentations.

Your new amazing deck is one click away!